For a long time, many Nigerian businesses treated their websites as optional. Something nice to have. Something for credibility. Something marketing would handle later.

That era is over.

With Nigeria tax law 2026 and regulatory landscape, your website is no longer just a digital storefront. It is now part of your business records, your compliance footprint, and in some cases, your legal exposure.

Whether you are a startup founder, an SME owner, or running a growing enterprise, it is important to understand how Nigeria tax law 2026 affects not just how you earn money, but how you present, record, and report that money online.

This article breaks it down in plain language.

Nigeria Tax Law 2026: Why Your Website is No Longer Optional

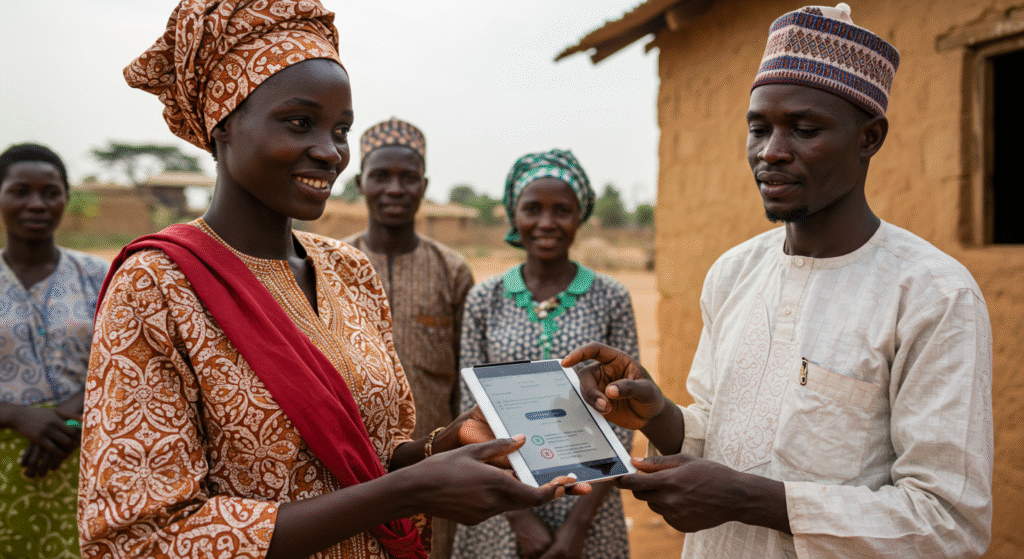

Tax authorities are no longer focused only on physical shops, offices, or paper records. Business has gone digital, and regulation has followed closely behind.

Today, your website can reveal:

- How you price your products or services

- How you invoice customers

- Whether you collect VAT

- Whether you sell locally or internationally

- How payments are processed

- Whether records are traceable

From a regulatory point of view, your website tells a story about how your business operates. And if that story does not match your tax filings, accounting records, or regulatory obligations, that is where problems start.

This is why business website compliance is becoming more important for Nigerian SMEs than ever before. because of the Nigeria tax law 2026.

The Shift in Nigeria’s Tax Approach

Nigeria’s tax system is gradually shifting from reactive to data driven.

Instead of waiting for businesses to submit returns and hoping they are accurate, authorities are increasingly interested in digital trails. Payment platforms, accounting software, POS systems, and yes, websites.

This does not mean every business is being watched in real time. But it does mean inconsistencies are easier to spot.

For example: If your website shows prices inclusive of VAT, but your filings do not reflect VAT collections, questions will be asked.

If your website sells digital services to international clients but your records show only local revenue, that raises flags. If customers can pay you online, but your accounting records are incomplete or manual, that gap matters.

Nigeria tax law 2026 is not just about higher rates or new rules. It is about visibility.

Your Website Is Now a Business Record

Many business owners still separate their website from their operations.

In reality, your website is now part of your financial ecosystem.

It connects to:

- Payment gateways

- Invoicing systems

- Accounting records

- Inventory or service delivery

- Customer data

This means what appears on your website should align with what happens in your books. If your website says one thing and your accounting says another, compliance becomes difficult to defend.

This is where many Nigerian SMEs struggle. Not because they want to evade tax, but because their systems are fragmented.

Common Website Compliance Issues Nigerian SMEs Face

Let us talk about real issues businesses run into, not theoretical ones.

Inconsistent Pricing Information

Some websites list prices without VAT, others include it, and some do not clarify at all. This creates confusion not just for customers, but for accounting and tax reporting.

Your website should clearly reflect how pricing works and whether VAT applies.

No Proper Invoicing Flow

Many businesses collect payments through their websites but still issue invoices manually or not at all. This breaks the audit trail.

If money enters your business digitally, your invoicing and accounting should reflect that same digital trail.

Poor Integration Between Website and Accounting

A website that operates separately from accounting software increases the risk of missing income, duplicated entries, or inaccurate reporting.

This is one of the biggest compliance risks Nigerian SMEs face today.

Outdated or Incorrect Business Information

Incorrect company names, addresses, or registration details on websites may seem minor, but they matter when regulators compare records.

Why Manual Workarounds No Longer Work

For years, many businesses survived using a mix of Excel, WhatsApp messages, bank alerts, and memory. That approach is becoming risky.

As tax systems become more structured and digital, manual processes create gaps. Gaps lead to errors. Errors lead to penalties.

This is why businesses are moving toward integrated systems where websites, sales, accounting, and reporting talk to each other. Not because it is fancy, but because it is safer.

The Role of ERP Systems in Website Compliance

An ERP system helps connect the dots. When your website is connected to a system like Odoo, several things improve immediately:

- Sales recorded on your website flow directly into accounting

- Invoices are generated automatically

- VAT and taxes are tracked consistently

- Financial reports reflect actual activity

- Records are easier to produce when needed

This is especially important for Nigerian SMEs that are growing and attracting more attention from regulators, partners, and investors. You will need to study the Nigeria tax law 2026 to have your website ready to be audited.

Compliance Is Not About Fear. It Is About Control.

There is a misconception that compliance is about fear of tax authorities. But compliance gives you control.

When your website, accounting, and reporting are aligned:

- You know your real revenue

- You understand your tax obligations

- You can plan cash flow better

- You can grow with confidence

Nigeria tax law 2026 is pushing businesses toward better structure. Those who adapt early will find it easier. Those who ignore it will feel the pressure later.

What Nigerian SMEs Should Do Now

You do not need to panic or overhaul everything overnight. But you do need to be intentional.

Here are practical steps to start with:

- Review what your website says about pricing, payments, and services.

- Ensure VAT and tax information is clear and accurate.

- Check whether online payments are properly recorded in your accounting system.

- Reduce manual processes where possible.

- Consider integrating your website with a proper accounting or ERP system.

These steps are not about perfection. They are about alignment.

Where TSM Fits In

At TSM, we see this problem every day.

Businesses come to us thinking they need a new website. What they actually need is a website that works as part of their business system.

We help Nigerian SMEs build websites that are not just beautiful, but compliant, connected, and scalable. And fits the Nigeria tax law 2026.

From website development to ERP and Odoo implementation, our focus is simple. Help businesses operate clearly, efficiently, and confidently in a changing regulatory environment.

Because your website should not be a risk. It should be an asset.

Final Thoughts

Nigeria tax law 2026 environment is evolving. Digital business is no longer invisible. Websites are no longer separate from operations.

Your website now speaks on your behalf, to customers, partners, and regulators. Make sure it is saying the right things.

Nigeria tax law 2026 is not something to fear. It is a signal that structure, clarity, and integration matter more than ever.

And businesses that respond early will always be ahead.